5 Ways to 3X Your Customer Lifetime Value AND Your Company Value

We all have dreams of success when it comes to building our companies.

It’s hard not to dream when companies today seem to be scaling and exiting faster than ever… and for more money than ever.

Some entrepreneurs want to build their company, scale, sell, and exit.

Others want to “make it”, and their success represents more than the money.

Whatever perspective you have for your company, a lot of factors come into play when scaling your business to an eventual exit.

- Brand

- Customer/User base

- Revenue

- Profits

The main metric that most acquirers care about is the revenue generated from your current and future customers: their customer lifetime value (LTV).

By and looking at your business through an LTV lens, you’ll gain insight into who your customers are and how much value they bring to your business over a specified period of time.

In this article about tripling your business value we’ll discuss:

[block_bg bg=”1292dd”]

- What is LTV?

- How can you calculate your LTV?

- Using cross-selling on product pages

- Using product upsells at checkout

- Implementing a rewards program

- Adding a subscription service

- Product bundling

- Product categorization

[/block_bg]

Feel free to use the above list to jump to a section you’re interested in. However, all areas addressed here are equally important if you want to fully understand and optimize your LTV.

What is Customer Lifetime Value?

Customer lifetime value is a metric that represents the total net profit a company makes from any given customer. It is a projection to estimate a customer’s monetary worth to a business after factoring in the value of the relationship with a customer over time. This time period will vary by business.

LTV is an important metric for determining how much money a company wants to spend on acquiring new customers, and how much repeat business a company can expect from certain consumers. (source)

If you want to know how to calculate your own LTV, check out this article we wrote here.

Segmenting Your Customers

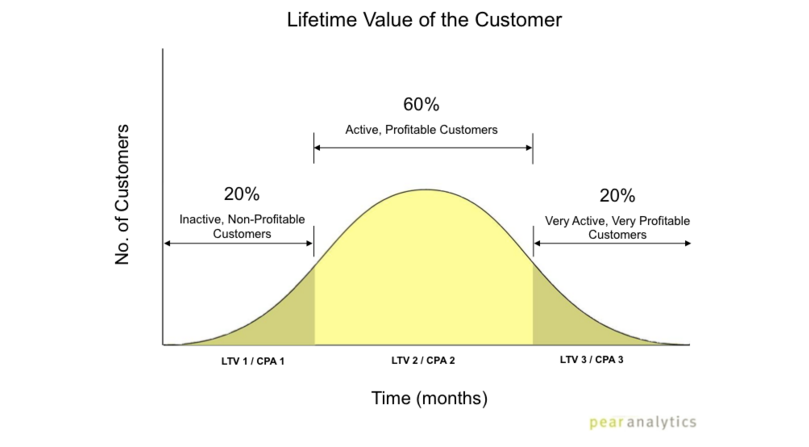

Rather than grouping all your customers into one lump, it’s best to recognize your least profitable customers, your customers that hang in the middle, and your top spenders.

You can do this by segmenting your customers based on their spending. Pear Analytics provides a great illustration to show an example segmentation of customers into ‘inactive’, ‘active’, and ‘very active’ groupings:

The ideal process would be to move as many customers from the “inactive” and “active” stages to the “very active” stage, where profits are higher and your cost per acquisition decreases.

Spending less on acquiring new customers and doubling down on your most profitable ones will give you a higher return on investment in the long-run.

How to Calculate Customer Lifetime Value

Calculating your LTV can get quite complex. The good people at KissMetrics have put together a very thorough infographic and case study about this calculation, using Starbucks as an example.

Let’s look at this graphic:

Using this graphic as a guide, you can perform this calculation for each segment of your customers.

By calculating a value for each segment of your customer base, you can feel comfortable making goals for each segment to improve their LTV.

Once you have a goal for each segment, you should then further segment each group by channel so you can see which one has the best performance.

You can determine these channels by correctly using your analytics, whether you are using Google Analytics or a paid service like Jirafe.

Now, you’re ready to build a strategy.

We’re going to focus on your “active” customers. Those that aren’t yet super-fans, but aren’t just one-time purchasers. They probably make up the majority of your customer-base, so let’s look at ways to move them over into the “very active” segment.

1. Product Cross-Sells and Upsells

If you haven’t tried implementing a method to suggest additional products to your customer, your opportunity to increase their average order value is low. Cross-selling and upselling are ways to accomplish this.

Of course, like anything in the user experience (UX) design of your store, it has to be done right to be effective.

First, let’s look at cross-selling.

Ecommerce Cross-Selling

Dick’s Sporting Goods has garnered lots of attention lately for their ecommerce efforts and omnichannel expansion. They’ve actually made a goal to double their ecommerce revenue by 2017! (source)

They’re being very strategic about capturing more digital sales and cross-selling is a part of this plan.

Because they have such an extensive inventory to work with, Dick’s can easily cross-sell, or suggest additional products for their customers to purchase.

Examining one of their product pages, you can see they suggest additional products that are complementary to the product being viewed. Because they are related thematically, the shopper is more probable to add one of these items to his / her cart.

So, this purchase just went from $17.99 to potentially over $40! Not bad.

This is an obvious increase to your customer’s average order value, which directly affects your customer lifetime value if you reference the equation from the introduction.

How to Upsell a Product

Birchbox does many things right, but their implementation of an upsell is a good one to study.

Why? Because it plays off the psychology of the consumer.

Here’s an example of their upgrade option once a user has selected a “monthly” or “yearly” plan:

The customer can receive two, full-size luxury products in each box for just $20 more. When the user is receiving a box full of sample-size products, receiving two full-size ones is attractive – not to mention they’re ‘luxury’ products.

And, most of all, the price point is right. It’s priced high enough to be an obvious boost for the company, if added, but palpable enough for the consumer to upgrade.

This is an upsell done right.

Upsells obviously increase the average order value for your customer and, in turn, improve the overall customer lifetime value of your company.

Related: How To Generate High Customer Engagement Like Birchbox & Bevel

2. Ecommerce Rewards Programs

Skincare beauty brand, Strivectin, has an impressive rewards program to encourage their customers to spend more. But, the program also has a positive side-effect other than increasing sales: increased brand awareness.

Customers can earn points to achieve specified rewards, like $20 toward their next purchase. However, earning those points is what drives the “side effect” of brand awareness.

Points are earned through social sharing and product reviews. The brand, in turn, receives exposure to potential customers who may not know about the brand or its products. Additionally, that exposure is coming from a “trusted source” if they are socially connected to the customer.

That’s some quality advertising.

Rewarding your customers for shopping with your brand increases your LTV because it encourages repeat shopping. By creating an attractive incentive for customers to come back, you’re moving them from the “active” segment to the “very active” (and more profitable) segment.

3. Adding a Subscription Service

Looking at your products, there may be some that you are selling which lend themselves to a subscription model.

I’m not talking about switching your entire ecommerce business model to a subscription model, but rather taking a product you offer that people buy regularly and offering a subscription.

Let’s look at an example:

The Honest Company offers eco-friendly, safe products for your home and babies. One of their most popular products is their diaper subscription.

A newborn baby requires more than 6 diapers per day, and because of this high volume, parents bought this product in bulk in the past.

Now, it’s more logical and convenient to just subscribe to a diaper delivery and avoid stockpiling Pampers in your garage. Honest recognized this huge opportunity and capitalized on it.

As a result, they’ve increased their customer lifetime value. Rather than having one person purchase a large quantity of diapers one time, customers now are “locked into” a specified duration of time.

This also makes predicting your customer lifetime value much easier, as you have a better idea of the timespan during which this person will interact with your company.

Related: 5 Reasons a Subscription Model is the Best Choice for Your Ecommerce Business

4. Product Bundling

Grouping products together in bundles does 2 important things: achieves risk mitigation for the buyer and allows you to generate more revenue per order which directly affects your LTV.

Walmart has recently been pumping funds into beefing up their online presence, especially their ecommerce and mobile sites in and attempt to keep up with companies like Amazon. (source)

Their online revenue is improving, and you can see that they are putting more effort into their UX design. Look at this example of bundling that appears on their iPad mini product page:

Walmart is encouraging the shopper to ”buy together and save”, and reinforces it by highlighting the savings in red. $50 is quite a savings, so the “risk” of buying 2 items instead of 1 seems a lot lower when the customer considers that he / she is saving a fairly significant amount.

Related: 3 Ways Product Bundling Increases Revenue

5. Product Categorization

Men’s lifestyle brand Huckberry does a great job of grouping products together in relevant categories which highlight popular interests of their customers.

Additionally, they have a featured section to visually attract a shopper and highlight activities in which they might be interested.

Why is this important?

This type of product categorization encourages the customer to engage in a “lifestyle”, versus just buying one product.

If this customer can then view all products related to the lifestyle, they’re more apt to make multiple purchases. It’s the activity they’re after, not just the product.

Product categorization not only increases your average order value, but it also improves your LTV in an additional way: it builds trust.

If your customer has a positive experience shopping through the lifestyle category, he / she is more likely to return to that section because of a sense of “trust” earned through a satisfactory experience.

Your customer will feel like you truly know him or her and that is something that will, no doubt, convert those “active” customers into “super-fans”.

Grow Your Business Value

The only way to get to your ideal business value is to continually make incremental improvements in how often your customers are purchasing. Even the smallest of improvements can deliver a significant increase in your overall business value.

What methods have you used to improve your customer lifetime value? Let us know in the comments.